Guys Is Article me hum baat karenge Easiest and Best Online Payment Gateway In India ke baare me. Apka business online ho ya offline Agar aap Online payment accept karna chahte hain to aapko Payment Gateway ki zaroorat padti hai. Aapki online shop hai, Aap product ya services sell karte hain, ya future me sell karne ki soch rahe hain. Aap individual, small business, ya corporate hain agar aap apni website, apps ya shop ke upar online payment accept karna chate hain to aapko payment gateway ki zaroorat hogi.

Payment Gateway Kya Hota Hai ?

Best Online Payment gateway ke baare me jaane se pahle hum jaante hain Payment Gateway Kya hota hai ?. Online Payment Gateway e-commerce website ko payment accept karne ki facility provide karate hain. Payment Gateway Seller and Buyers ke beech Paise ka len den karati hai, ye ek third party ki trah work karta hai. Payment Gateway Har Transaction par Merchants ya e-commerce site se kuch fees ( 2% – 3% ) leti hai.

Payment Gateway e-commerce website ko ek secure, fraud proof payment system provide karata hai, jahan user apne manchahe payment methods ke hisab se payment kar sakte hain. Merchants ya e-commerce website Apne Payment Gateway Dashboard se sabhi transaction ko dekh sakte hain, Refund ki situation me Directly Payment gateway dashboard se refund kar sakte hain.

Payment gateway Payment accept karne ke baad 2-3 days ke andar Merchants ke account me wo paise Transfer (Settle) kar deti hai.

Best Online Payment Gateway Kaise Find Kare

Market me kafi saare online Payment Gateway options available hain, lekin unme se aapke liye, aapke business ke liye best online payment gateway konsa hai ye jaana bhot zaroori hai. to chaliye jaante hain or find karte hain apne liye Best Online Payment Gateway.

Best Online Payment Gateway find karne ke liye aap kuch chizon par research kar sakte hain.

- Documentation and Approval Process

- Available Payment Options

- Transaction Fees

- Settlement Time

- Integration

- Support

1. Documentation and Approval Process

Documentation and Approval process kisi bhi payment gateway ke upar sign up karne ka sabse pahla process hota hai. har Payment Gateway ka apna alag alag Documentation and Approval process hota hai. Aapko ye dekhna hai ki aapke ke paas kya kya documents hain or use Gateway ke Documentation requirements se match karna hai. Hum Zyada complicated Documentation process nhi chahte hain. Balki Paper Work na ho to zayada behtar hai.

2. Available Payment Options

Jis Payment Gateway ke paas jitne zyada Payment Options honge wo utna zayda behtar hoga. Payment Options matlab Buyers kitne tarike se Payment kar sakta hai, Like Credit/Debit card, Visa/Master, Rupay, American Express, Dinner, Internet Banking, Wallets (Paytm, Jio Money, Mobikwik, Google Pay), UPI etc. So payment options ke baare me bhi aapko research karna hai.

3.Transaction Fees

Payment Gateway har Transaction par 2% – 3% charge karti hai. Matlab aapki website par koi INR.100 ka kuch buy karta hai to usme se 2-3% Payment gateway apna Fees kat kar 97-98% aapko degi. To aapko fees ke baare me kafi dhayan se research karna hai. Normally 2% Domestic Transaction and 3% International Transaction hota hai. Aapko ye bhi dhayaan dena hai ki koi Monthly ya Yearly charges to nahi hai.

4. Settlement Time

Payment Accept hone ke baad Payment gateway kitne dino ke andar Payment Settle karta hai ya Payment aapke bank account me transfer karta hai ye jaanna bhi bhot zaroori hai. Jiska Settlement time jitna fast hoga, wo payment gateway utna acha hoga. Normally 1-5 days Payment Settlement time hota hai.

5. Integration

Website Ya Apps par Payment Gateway Enable karne ke liye Payment Gateway Software Setup karna hota hai. Har website, Apps alag alag platform par develop hoti hai. Ab aapko ye dekhna hai ki aapka website kis platform par develop kiya gaya hai or usse related Payment Gateway Software ya Kit Available hai ya nhi.

6. Support

Support ek bhot hi important part hai, Aapko koi bhi problem hoti hai Technical, Transaction, ya Integration se related to aapko Payment gateway ki traf se kitni jaldi support milta hai ye bhot zaroori hai. 24×7 support ho to zayada behtar hai.

So Aapko upar di gayi sari baaton par reserch karna hai or uske according aapko apne liye, apne business ke liye best Payment gateway find karna hai.

Best Online Payment Gateway In India For Startup

India me kafi saare payment gateway hain jaise ki – PayKun, Bill Desk, CCAvenue, Citrus, PayUmoney, PayUBiz etc. Lekin Hum Specially baat kar rahe hain Startup, Individual or small business ki, So upar ke sabhi points ke upar research karne ke baat Best Online Payment Gateway In India For Startup hai PayKun Payment Gateway.

PayKun Payment gateway Startup, Individual, ya small business ke liye ek best option hai. kion inka Documentation process kafi aasan hai, PayKun ke upar signup karna kafi aasan hai.

PayKun Payment gateway Features

- No setup cost

- No annual maintenance cost

- No hidden charges

- Payment Gateway Apne website and Apps me setup karna aasan hai.

- Payment Settlement Time T+3 (3 days ke andar) hai. jabki doosre Gateway T+5 – T+7 days ka time lete hain.

- Payment Retry Option

- Transaction success rate kafi high hai, saath hi aapko kafi details me initialized, failed, Not-attempted transactions ki details mil jaati hai.

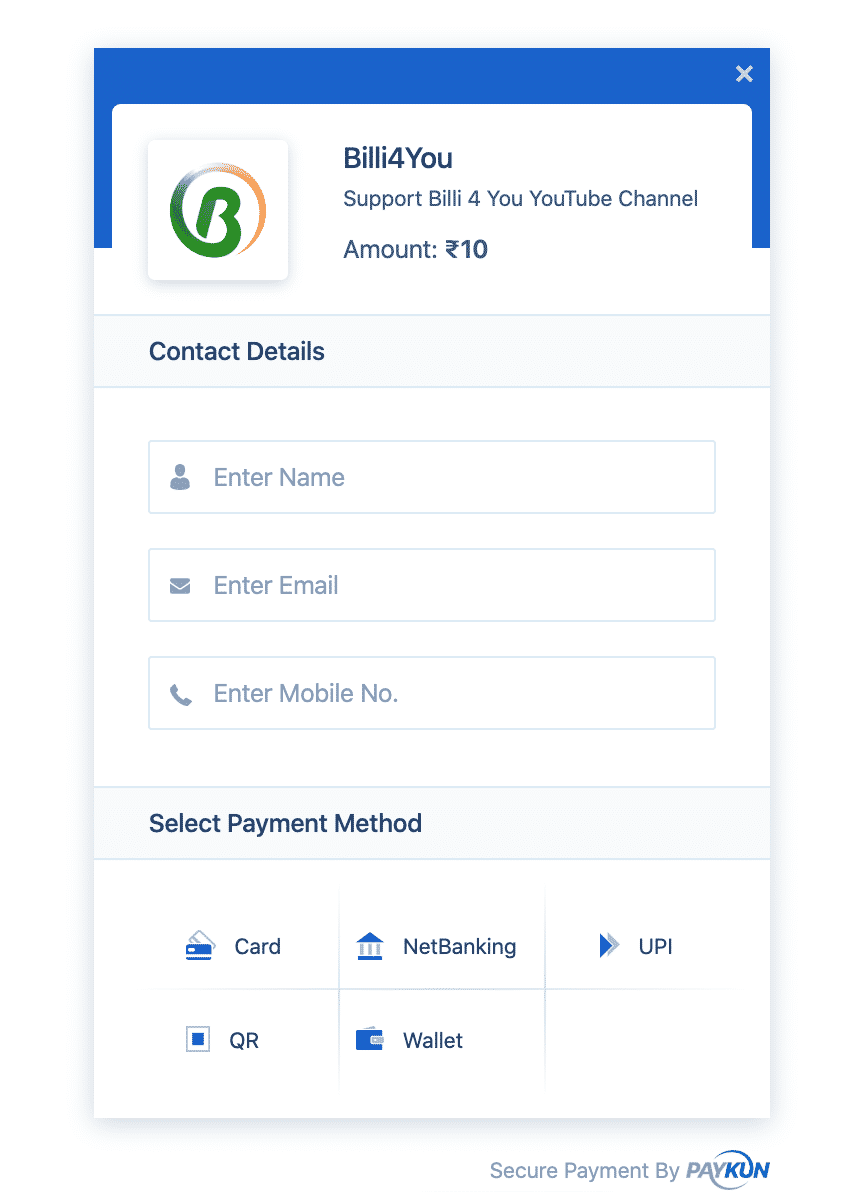

- Aap payment link create kar sakte hain single ya multiple user ke liye. (Demo Payment Link : https://billi.me/Support_Billi )

- Master Payment Link option aapko mil jaata hai, jahan user kudse ammount daal kar payment kar sakta hai. Here is demo link https://paykun.in/master_payment_link

- Aap One Click me Refund kar sakte hain.

- PayKun Account create karne ke liye Website and Apps Zaroori nahi hai.

- Paperless, Quick & Easy Onboarding

- Powerful Dashboard(Easy and User-friendly UI)

- Support available by email, chat & call

- Personal dedicated assistance

PayKun Payment Options

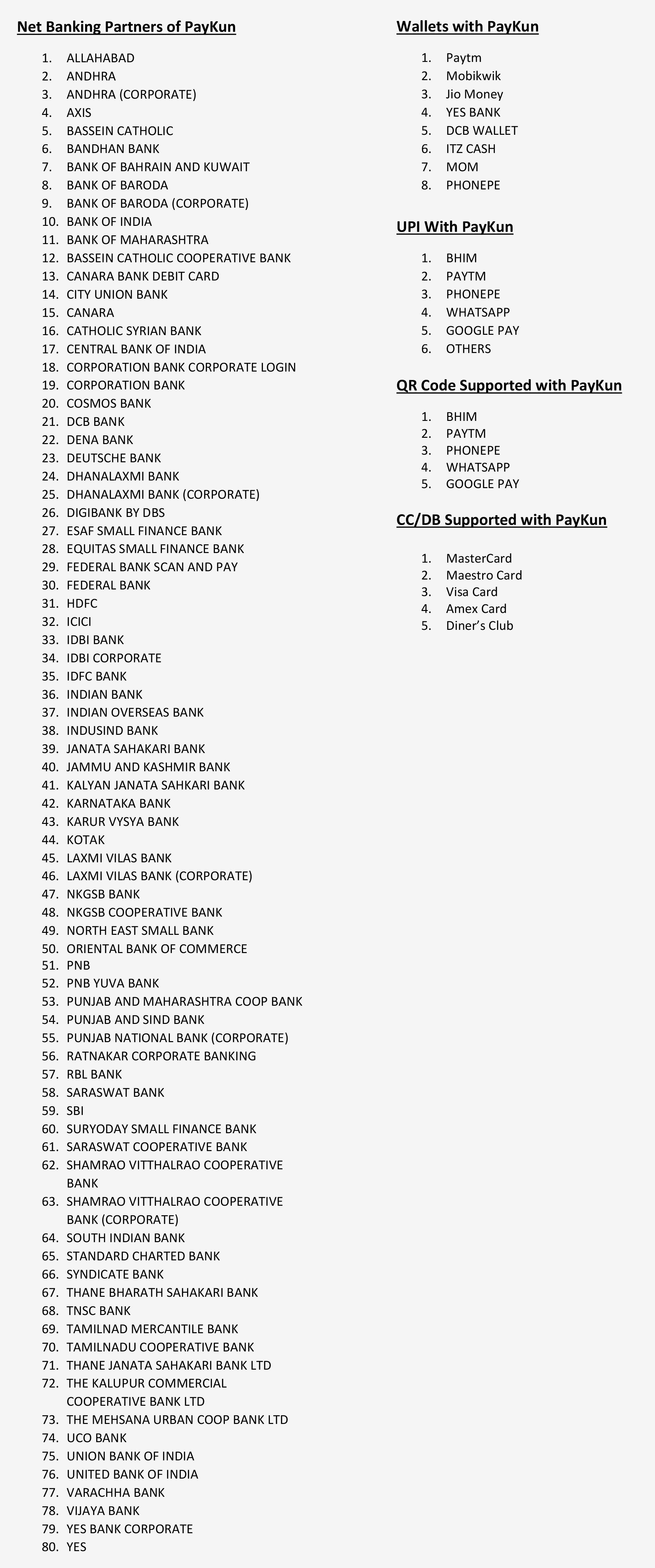

PayKun me aapko 120 + payment option mil jaate hai. Guid

- Debit/Credit cards, Master Card, Visa, Rupay, Diners Club

- 80+ Net Banking

- Wallets (Paytm, Mobikwik, JIO Money, Yes Bank, DCB Wallets, ITZ Cash, MOM, Phonepe)

- UPI/BHIM (Bhim, Paytm, Phonepe, Whatsapp, Google pay)

- Single QR Code (Bhim, Paytm, Phonepe, Whatsapp, Google pay)

- Payment Link

PayKun Fee Structure

Domestic Rates

| Rate | Flat 2% on transaction amount + GST |

| Settlement | T + 1 to T+3 working days(depends on business model) |

Internation Rates

| Rate | Flat 3% on transaction amount + GST |

| Settlement | T + 1 to T+3 working days(depends on business model) |

PayKun Documentation Requirements

- GST Certificate/Shop Act Licence/Udhyog Aadhar (anyone out of these 3)

- PAN Card

- Aadhar Card (scanned both sides)

Guys Ummid hai Aapko kafi saari chizen is article me jaanne ko mili hongi. Agar aapka koi sawal hai to aap humse comment section me pooch sakte hain.